Income Tax Itemized Deductions Worksheet

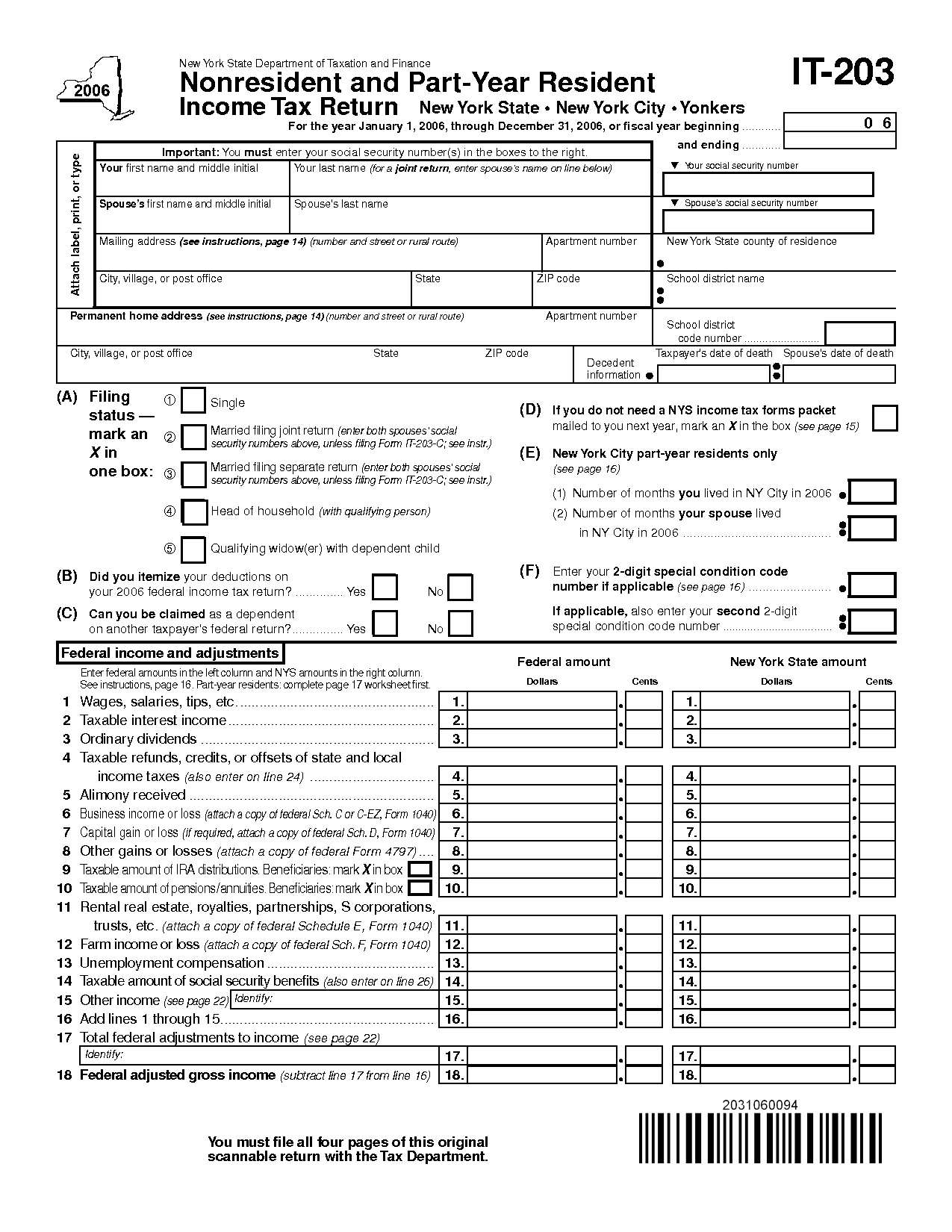

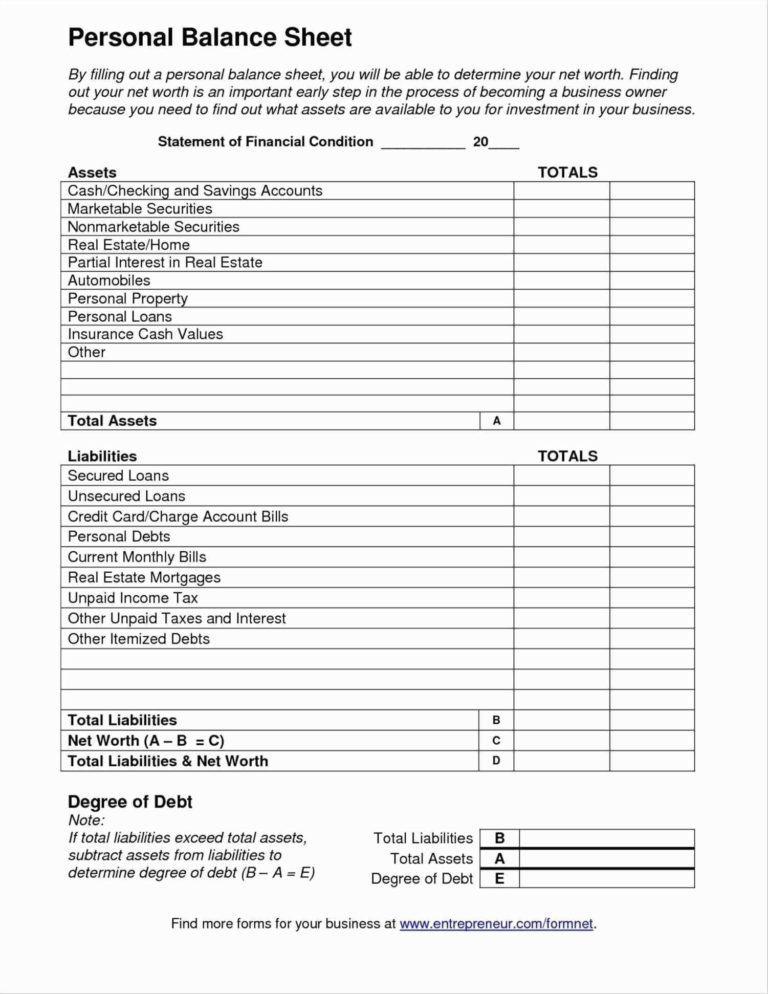

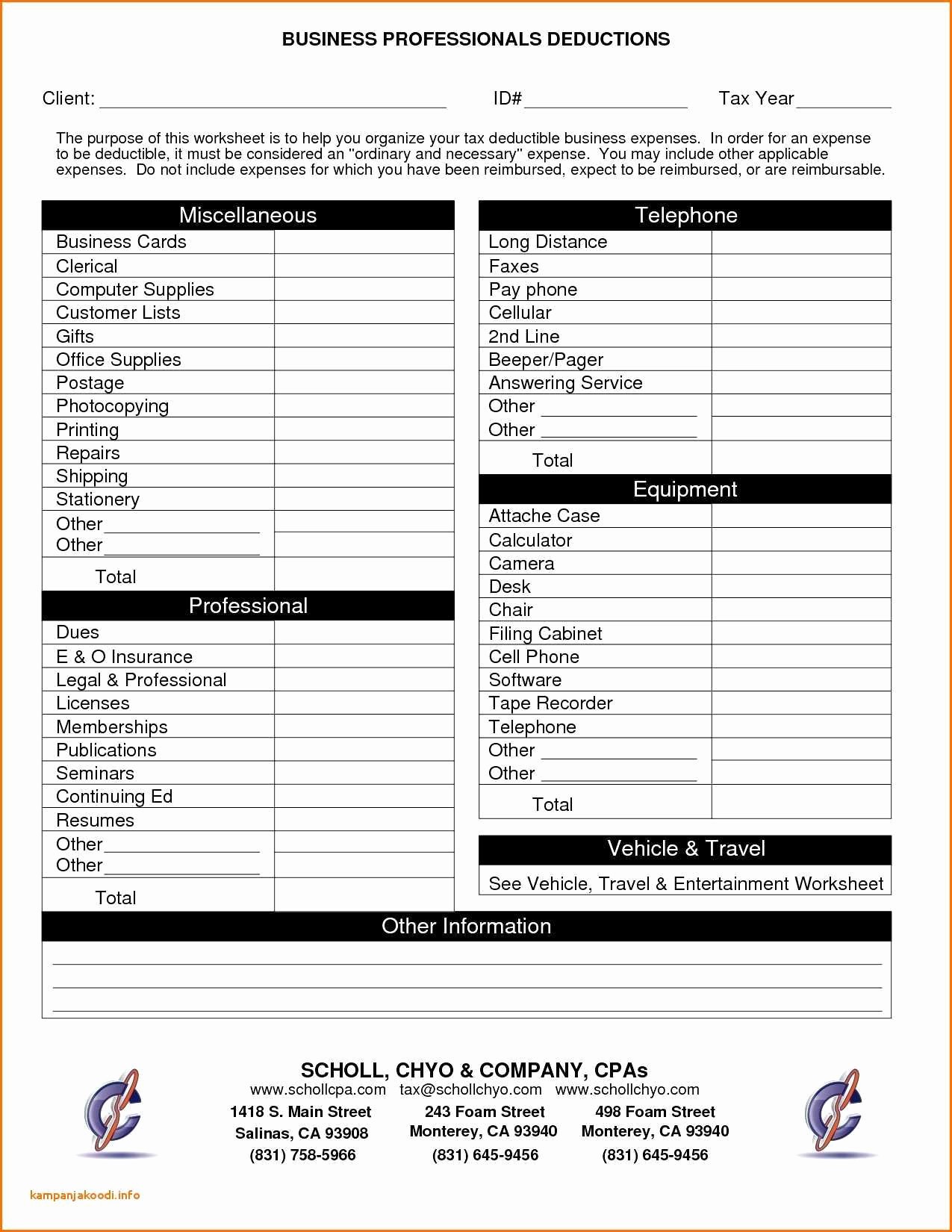

Income Tax Itemized Deductions Worksheet - 2 estimated deductions (oklahoma standard or itemized). The source information that is required for each tax. Web california does not allow a deduction for foreign income taxes. Web if the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. Web 1 estimated total income for tax year (less income exempt by statute). Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. This worksheet allows you to itemize your tax deductions for a given year. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Web itemized deduction worksheet medical expenses. Beginning with tax current 2018, the tax rights allows you to itemize your rebates for new york state income tax purses whether with. Web enter your standard deduction on line 17 of form 502 or line 2 of form 503. Beginning with tax current 2018, the tax rights allows you to itemize your rebates for new york state income tax purses whether with. Web 1 estimated total income for tax year (less income exempt by statute). 2 estimated deductions (oklahoma standard or itemized).. Web pdffiller makes it easy to finish and sign hair stylist tax deduction worksheet form online. Enter that amount on line 6, column b. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. It lets you make changes to original pdf content, highlight, black out, erase, and write text. 2 estimated deductions. Web enter your standard deduction on line 17 of form 502 or line 2 of form 503. Mortgage interest you pay on. Web itemized deduction worksheet medical expenses. Web 1 estimated total income for tax year (less income exempt by statute). This worksheet allows you to itemize your tax deductions for a given year. Nter the estimated amount of your 2022 itemized deductions. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Types of itemized deductions include mortgage. Web pdffiller makes it easy to finish and sign hair stylist tax deduction worksheet form online. Mortgage interest you pay on. Mortgage interest you pay on. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Must exceed 7.5% of income to be a benefit. Web california does not allow a deduction for foreign income taxes. Web itemized deduction worksheet medical expenses. Web itemized deduction worksheet medical expenses. Web pdffiller makes it easy to finish and sign hair stylist tax deduction worksheet form online. Beginning with tax current 2018, the tax rights allows you to itemize your rebates for new york state income tax purses whether with. It lets you make changes to original pdf content, highlight, black out, erase, and write. Beginning with tax current 2018, the tax rights allows you to itemize your rebates for new york state income tax purses whether with. Federal law suspended the deduction for foreign property taxes. Web california does not allow a deduction for foreign income taxes. Web enter your standard deduction on line 17 of form 502 or line 2 of form 503.. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Web enter your standard deduction on line 17 of form 502 or line 2 of form 503. It lets you make changes to original pdf content, highlight, black out, erase, and write text. Must exceed. Web california does not allow a deduction for foreign income taxes. Web pdffiller makes it easy to finish and sign hair stylist tax deduction worksheet form online. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The source information that is required for each tax. Nter the estimated amount of your 2022. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Mortgage interest you pay on. Web download these income tax worksheets and organizers to maximize your deductions and minimize. Web california does not allow a deduction for foreign income taxes. This worksheet allows you to itemize your tax deductions for a given year. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Web enter your standard deduction on line 17 of form 502 or line 2 of form 503. Federal law suspended the deduction for foreign property taxes. Enter that amount on line 6, column b. Tax deductions for calendar year 2 0 ___ ___ hired help space. Web pdffiller makes it easy to finish and sign hair stylist tax deduction worksheet form online. 2 estimated deductions (oklahoma standard or itemized). It lets you make changes to original pdf content, highlight, black out, erase, and write text. Mortgage interest you pay on. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Web if the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web itemized deductions (2022) beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax purposes. Web itemized deduction worksheet medical expenses. Types of itemized deductions include mortgage. Web 1 estimated total income for tax year (less income exempt by statute). The source information that is required for each tax. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Nter the estimated amount of your 2022 itemized deductions. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): It lets you make changes to original pdf content, highlight, black out, erase, and write text. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Web pdffiller makes it easy to finish and sign hair stylist tax deduction worksheet form online. Web enter your standard deduction on line 17 of form 502 or line 2 of form 503. 2 estimated deductions (oklahoma standard or itemized). Web itemized deduction worksheet medical expenses. Mortgage interest you pay on. Tax deductions for calendar year 2 0 ___ ___ hired help space. Beginning with tax current 2018, the tax rights allows you to itemize your rebates for new york state income tax purses whether with. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The source information that is required for each tax. Web if the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. This worksheet allows you to itemize your tax deductions for a given year.12 Best Images of Federal Tax Deduction Worksheet 2014

10 2014 Itemized Deductions Worksheet /

Itemized Deductions Spreadsheet in Business Itemized Deductions

️Safe Worksheet Free Download Goodimg.co

California Itemized Deductions Worksheet

Itemized Deductions Worksheet Pdf Master of Documents

Small Business Deductions Worksheet petermcfarland.us

Haller Group AZ Tax Deduction Worksheet For Realtors Fill and Sign

️Fillable Itemized Fee Worksheet Free Download Goodimg.co

9 Best Images of Tax Deduction Worksheet Business Tax Deductions

Web California Does Not Allow A Deduction For Foreign Income Taxes.

Federal Law Suspended The Deduction For Foreign Property Taxes.

Must Exceed 7.5% Of Income To Be A Benefit.

Web Download Our Free 2022 Small Business Tax Deductions Worksheet, And We’ll Walk You Through How To Use It Right Now In This Blog Post.

Related Post: