Section 199A Information Worksheet

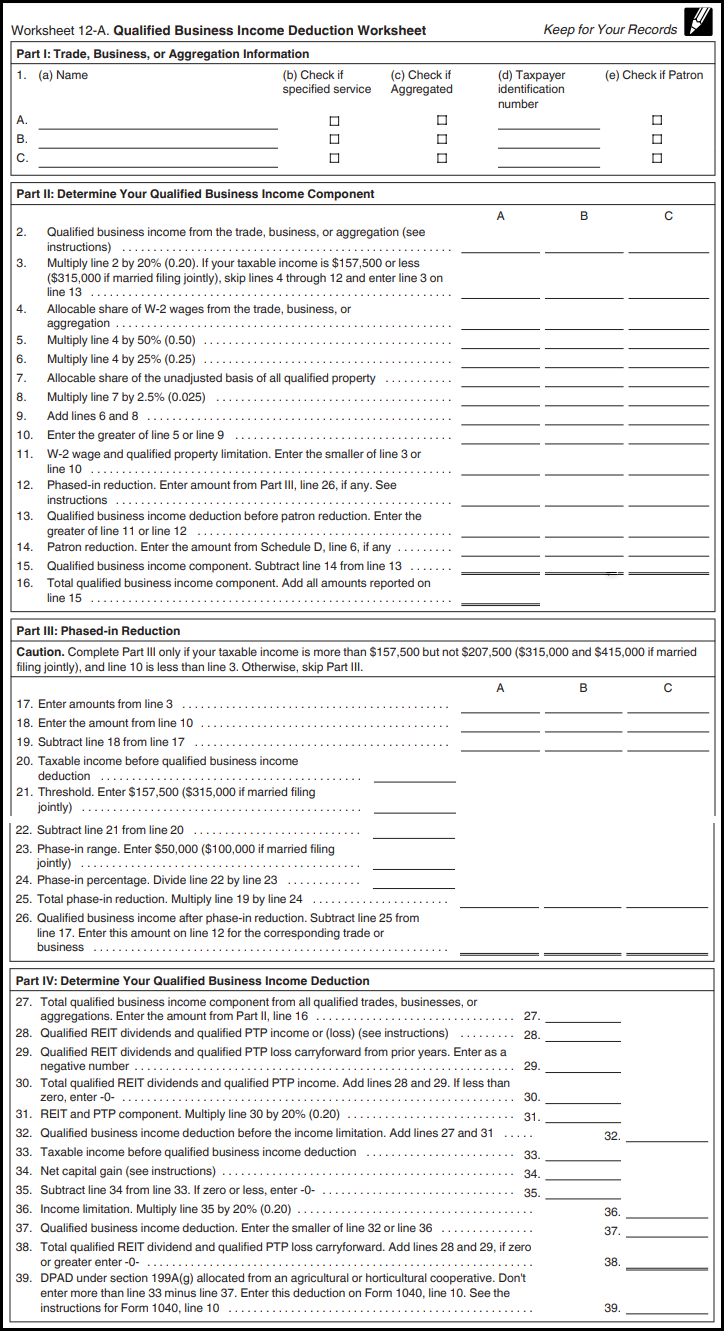

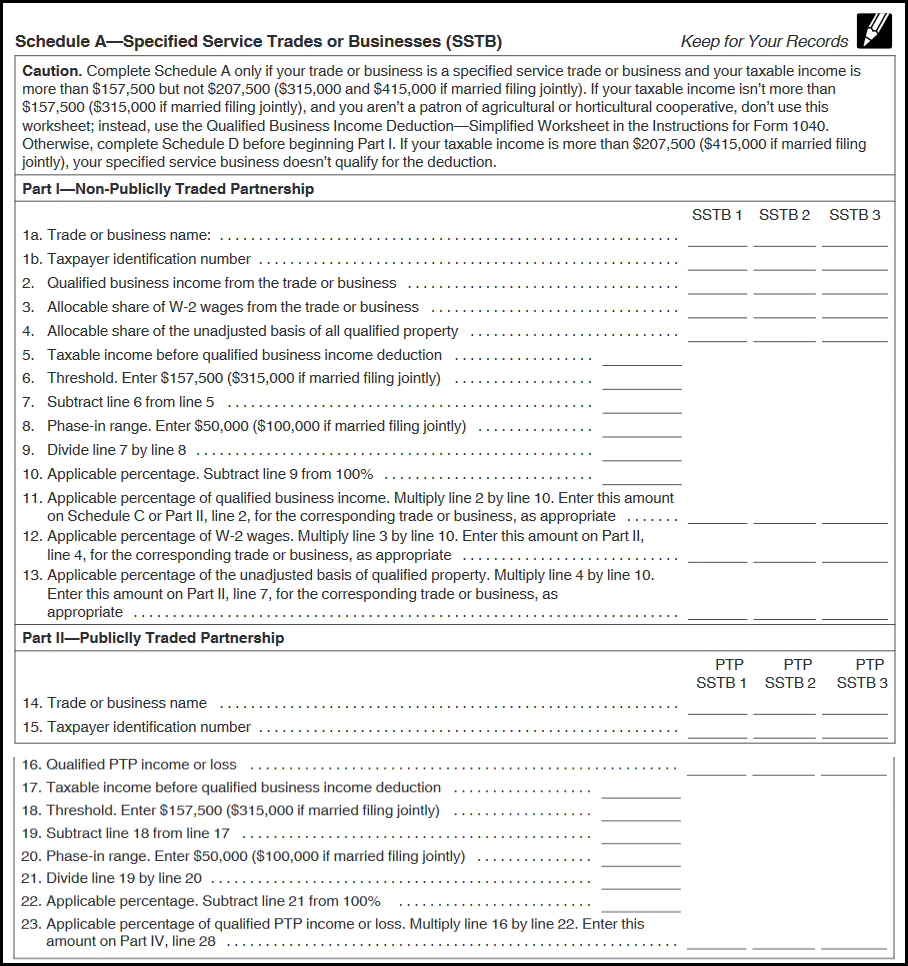

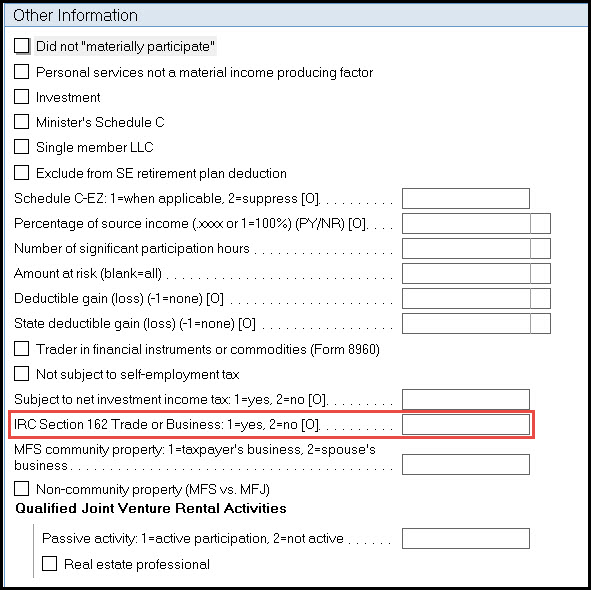

Section 199A Information Worksheet - Web section 199a information worksheet. The attached partner's section 199a worksheet. Go to income/deductions > business or rental and. Web section 199a information worksheet. Enter income and expenses within the schedule. Web to override the income amounts on the qbid (199a) worksheet for certain entities, do the following: Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a? Solved•by intuit•62•updated july 14, 2022. Web calculating the section 199a deductions. I have code ah* and value=stmt in box 20 of my k1. Go to income/deductions > business or rental and. The attached partner's section 199a worksheet. Web to override the income amounts on the qbid (199a) worksheet for certain entities, do the following: Solved•by intuit•62•updated july 14, 2022. Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section. Enter income and expenses within the schedule. Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section. Web how to enter section 199a information? Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a?. Go to income/deductions > business or rental and. Web section 199a information worksheet. Enter income and expenses within the schedule. Web section 199a information worksheet. Web how to enter section 199a information? Enter income and expenses within the schedule. Solved•by intuit•62•updated july 14, 2022. Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a? Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section. I have. The attached partner's section 199a worksheet. Web how to enter section 199a information? Web to override the income amounts on the qbid (199a) worksheet for certain entities, do the following: Go to income/deductions > business or rental and. Web section 199a information worksheet. Web how to enter section 199a information? I have code ah* and value=stmt in box 20 of my k1. Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section. Web section 199a information worksheet. Enter income and expenses within the schedule. Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a? Enter income and expenses within the schedule. Web to override the income amounts on the qbid (199a) worksheet for certain entities, do the following: Solved•by intuit•62•updated july 14, 2022. I have code ah* and value=stmt in. Enter income and expenses within the schedule. Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section. Web calculating the section 199a deductions. I have code ah* and value=stmt in box 20 of my k1. Web section 199a information worksheet. Web section 199a information worksheet. Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section. Enter income and expenses within the schedule. I have code ah* and value=stmt in box 20 of my k1. Web section 199a information worksheet. The attached partner's section 199a worksheet. Enter income and expenses within the schedule. Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a? Go to income/deductions > business or rental and. Web section 199a information worksheet. I have code ah* and value=stmt in box 20 of my k1. Web how to enter section 199a information? Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section. Web section 199a information worksheet. The attached partner's section 199a worksheet. Solved•by intuit•62•updated july 14, 2022. Web section 199a information worksheet. Web to override the income amounts on the qbid (199a) worksheet for certain entities, do the following: Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a? Go to income/deductions > business or rental and. Web calculating the section 199a deductions. Enter income and expenses within the schedule. Solved•by intuit•62•updated july 14, 2022. The attached partner's section 199a worksheet. I have code ah* and value=stmt in box 20 of my k1. Web section 199a information worksheet. Web section 199a defines specified service businesses to professional fields like law, financial services, accounting, architecture, and others as stipulated by section. Enter income and expenses within the schedule. Go to income/deductions > business or rental and. Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a? Web to override the income amounts on the qbid (199a) worksheet for certain entities, do the following:Lacerte Complex Worksheet Section 199A Qualified Business Inco

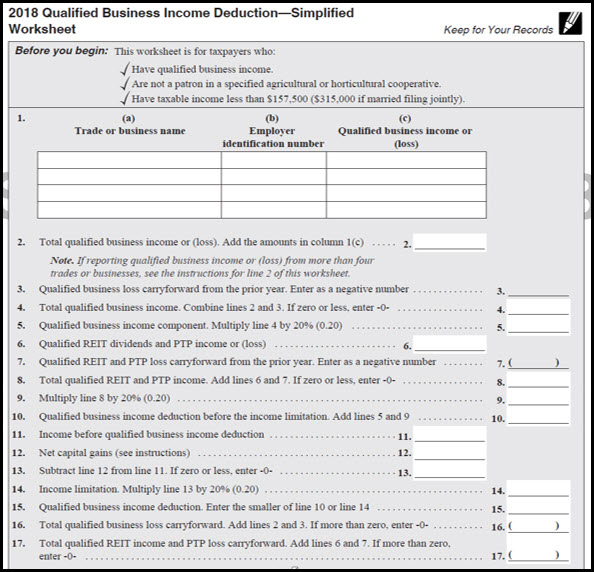

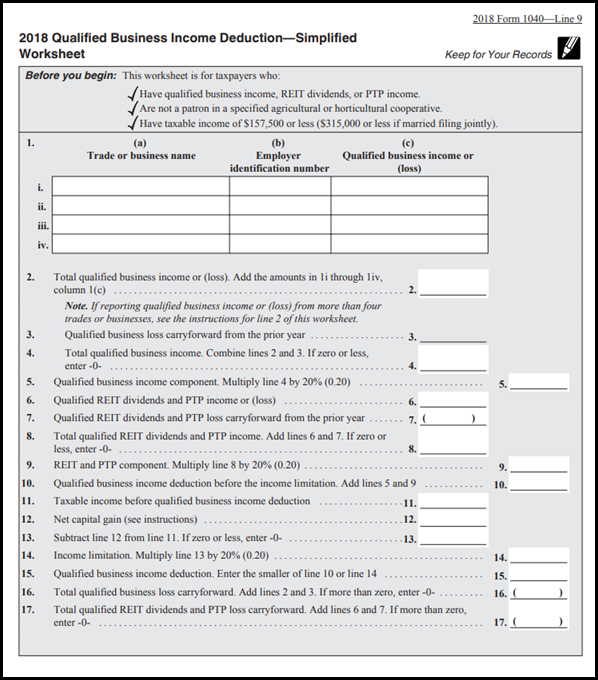

ProConnect Tax Online Simplified Worksheet Section 199A Qualif

Solved Inputting Section 199A information from Partnershi... Tax Pro

How to enter and calculate the qualified business deduction

Lacerte QBI Section 199A Partnership and SCorporate Details

Lacerte Simplified Worksheet Section 199A Qualified Business I

Section 199A on K1, but No "Statement A" Received

Lacerte Complex Worksheet Section 199A Qualified Business

Lacerte Complex Worksheet Section 199A Qualified Business Inco

Lacerte Simplified Worksheet Section 199A Qualified Business I

Web How To Enter Section 199A Information?

Web Section 199A Information Worksheet.

Web Calculating The Section 199A Deductions.

Related Post: