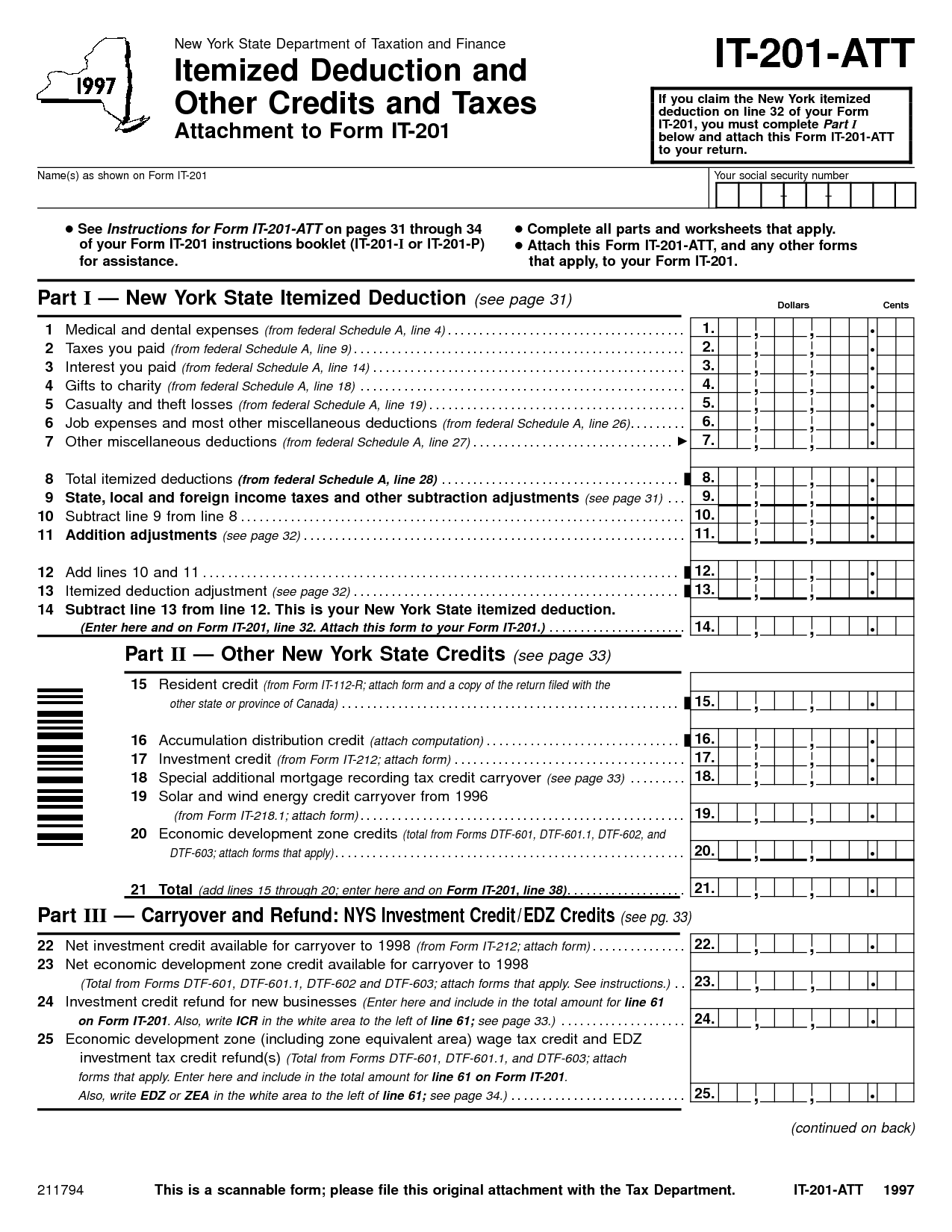

Standard Deduction Worksheet

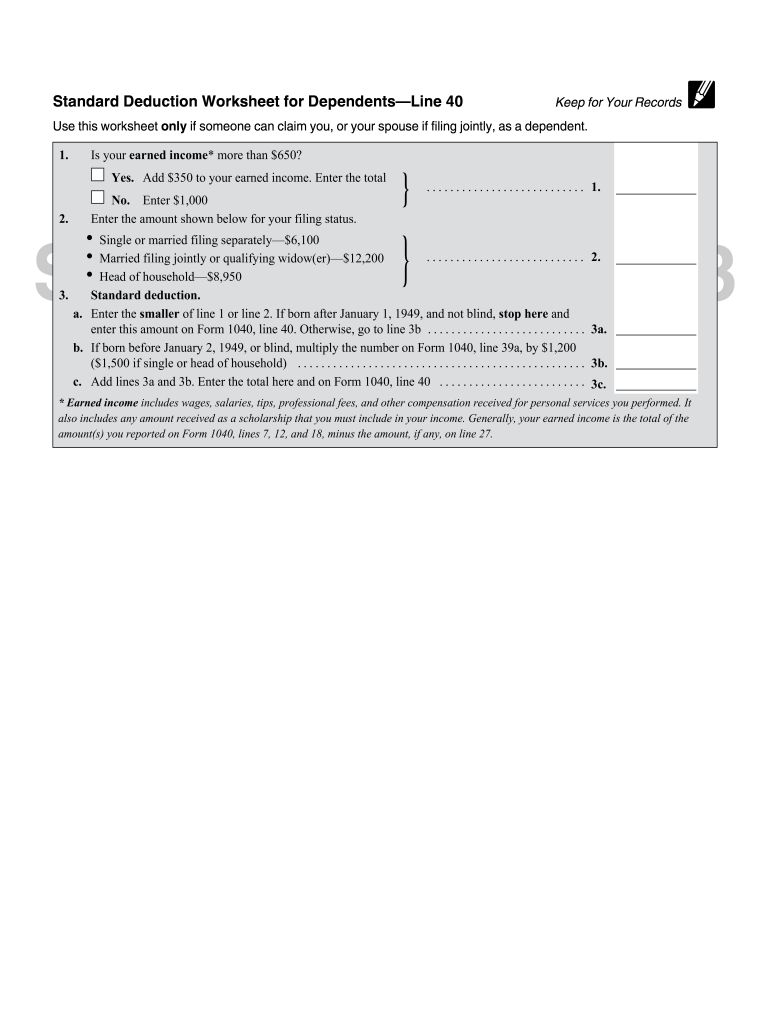

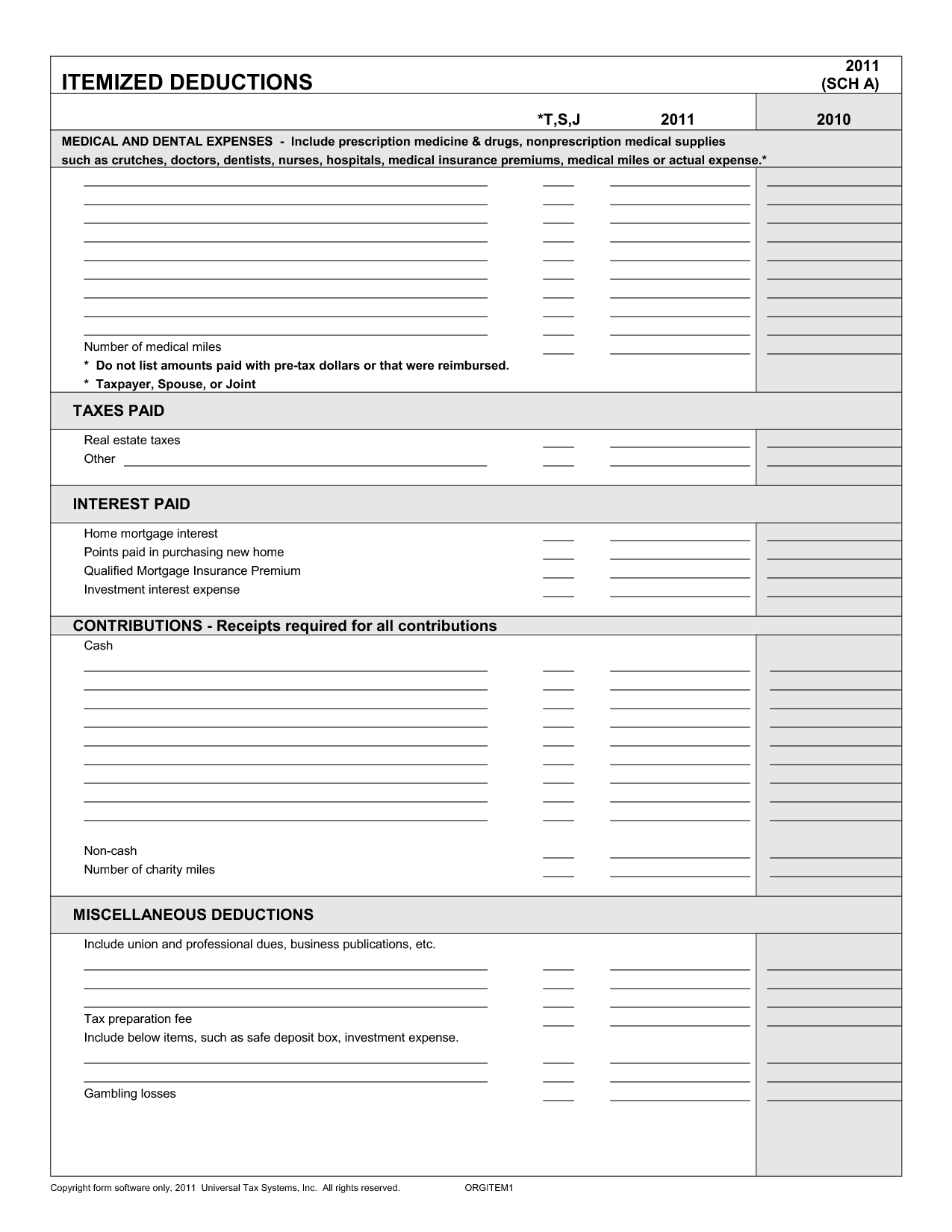

Standard Deduction Worksheet - We allow all filing statuses to claim the standard deduction. The tool is designed for taxpayers who were u.s. Web basic income information including amounts and adjusted gross income. Web get an overview state income tax brackets and standard deductions. Taxpayers who can be claimed as a dependent must use the standard deduction worksheet for dependents to determine their standard deduction. Web standard deduction worksheet for dependents (2022) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. We have a lower standard deduction than the irs. If you checked the box on form 540, line 6,. Web here is the standard deduction for each filing type for tax year 2022. Citizens or resident aliens for the entire tax. The tool is designed for taxpayers who were u.s. Web here is the standard deduction for each filing type for tax year 2022. Web get an overview state income tax brackets and standard deductions. Citizens or resident aliens for the entire tax. We have a lower standard deduction than the irs. The tool is designed for taxpayers who were u.s. Web get an overview state income tax brackets and standard deductions. Web basic income information including amounts and adjusted gross income. Do you qualify for the standard. If you checked the box on form 540, line 6,. Web here is the standard deduction for each filing type for tax year 2022. If you checked the box on form 540, line 6,. Taxpayers who can be claimed as a dependent must use the standard deduction worksheet for dependents to determine their standard deduction. Do you qualify for the standard. Web get an overview state income tax brackets and. Web get an overview state income tax brackets and standard deductions. Web basic income information including amounts and adjusted gross income. Web here is the standard deduction for each filing type for tax year 2022. Do you qualify for the standard. We have a lower standard deduction than the irs. We allow all filing statuses to claim the standard deduction. The tool is designed for taxpayers who were u.s. If you checked the box on form 540, line 6,. Do you qualify for the standard. Web basic income information including amounts and adjusted gross income. Do you qualify for the standard. Taxpayers who can be claimed as a dependent must use the standard deduction worksheet for dependents to determine their standard deduction. Web get an overview state income tax brackets and standard deductions. Citizens or resident aliens for the entire tax. We allow all filing statuses to claim the standard deduction. Web get an overview state income tax brackets and standard deductions. Taxpayers who can be claimed as a dependent must use the standard deduction worksheet for dependents to determine their standard deduction. Web basic income information including amounts and adjusted gross income. Do you qualify for the standard. We have a lower standard deduction than the irs. Web get an overview state income tax brackets and standard deductions. We allow all filing statuses to claim the standard deduction. Citizens or resident aliens for the entire tax. Web standard deduction worksheet for dependents (2022) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. We have a lower standard deduction. If you checked the box on form 540, line 6,. We have a lower standard deduction than the irs. Do you qualify for the standard. Taxpayers who can be claimed as a dependent must use the standard deduction worksheet for dependents to determine their standard deduction. Citizens or resident aliens for the entire tax. Citizens or resident aliens for the entire tax. We allow all filing statuses to claim the standard deduction. The tool is designed for taxpayers who were u.s. We have a lower standard deduction than the irs. Taxpayers who can be claimed as a dependent must use the standard deduction worksheet for dependents to determine their standard deduction. Web get an overview state income tax brackets and standard deductions. Taxpayers who can be claimed as a dependent must use the standard deduction worksheet for dependents to determine their standard deduction. Web standard deduction worksheet for dependents (2022) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. If you checked the box on form 540, line 6,. Citizens or resident aliens for the entire tax. We have a lower standard deduction than the irs. We allow all filing statuses to claim the standard deduction. Web here is the standard deduction for each filing type for tax year 2022. Do you qualify for the standard. Web basic income information including amounts and adjusted gross income. The tool is designed for taxpayers who were u.s. We have a lower standard deduction than the irs. Web standard deduction worksheet for dependents (2022) use this worksheet only if someone can claim the taxpayer, or spouse if filing jointly, as a dependent. Citizens or resident aliens for the entire tax. Web get an overview state income tax brackets and standard deductions. Taxpayers who can be claimed as a dependent must use the standard deduction worksheet for dependents to determine their standard deduction. Web basic income information including amounts and adjusted gross income. Do you qualify for the standard. If you checked the box on form 540, line 6,.9 Best Images of Tax Deduction Worksheet Business Tax Deductions

Standard Deduction Line Fill Online, Printable, Fillable, Blank

MT Worksheet V Standard Deduction 20172022 Fill out Tax Template

16 Best Images of Schedule C Deductions Worksheet Itemized Deduction

Ira Deduction Worksheet 2018 Tax refund, Graphing inequalities, Deduction

Itemized Deduction Worksheet How Many Tax Allowances Should You Claim

Standard Deduction Worksheet for Dependents

Home Office Deduction Worksheet HMDCRTN

10 2014 Itemized Deductions Worksheet /

10 2014 Itemized Deductions Worksheet /

We Allow All Filing Statuses To Claim The Standard Deduction.

Web Here Is The Standard Deduction For Each Filing Type For Tax Year 2022.

The Tool Is Designed For Taxpayers Who Were U.s.

Related Post: