What Is Federal Carryover Worksheet

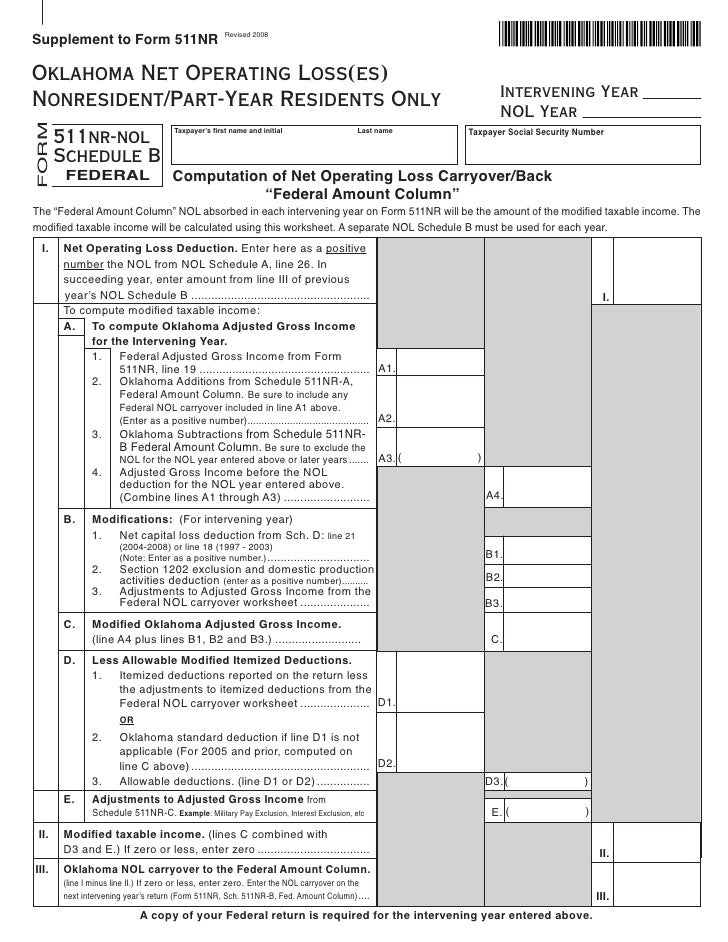

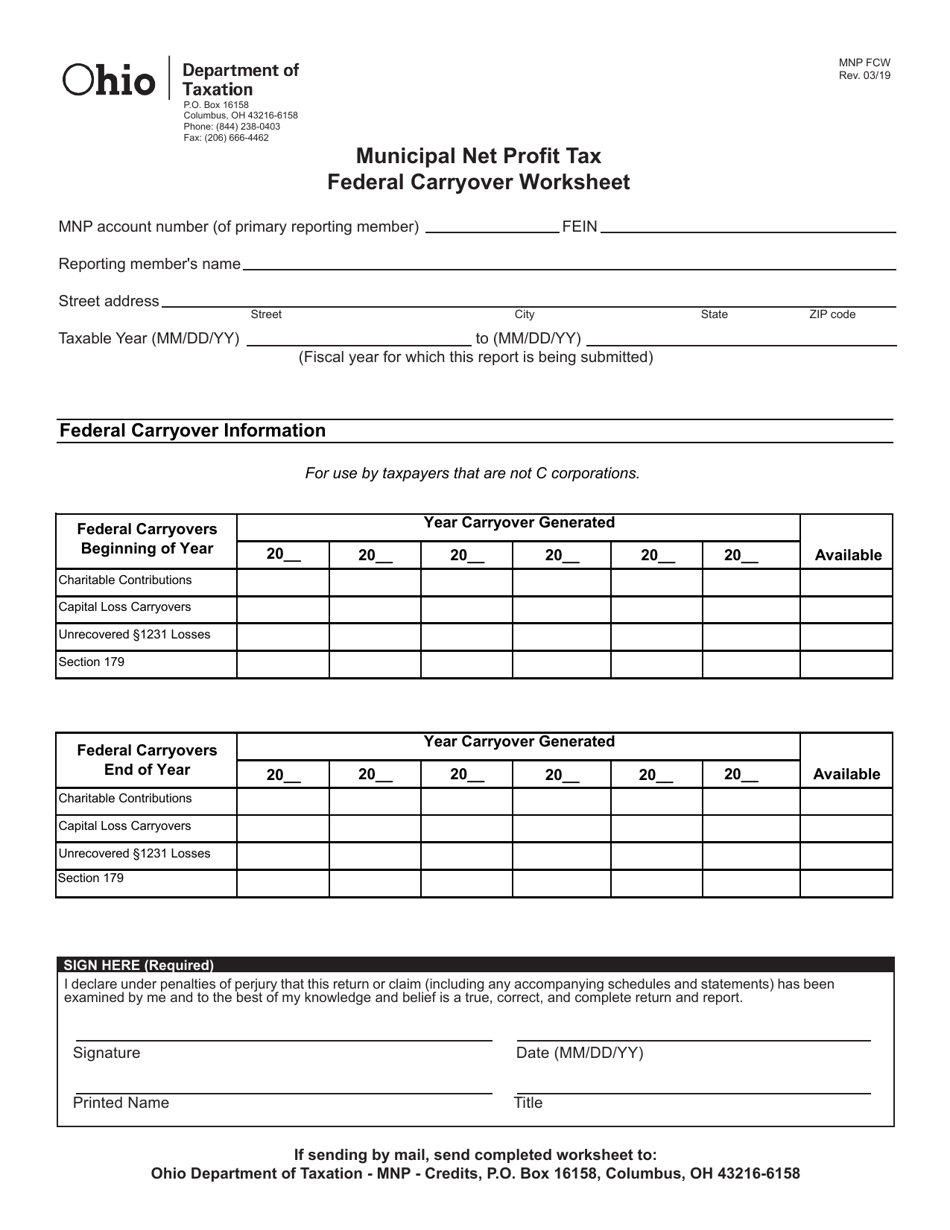

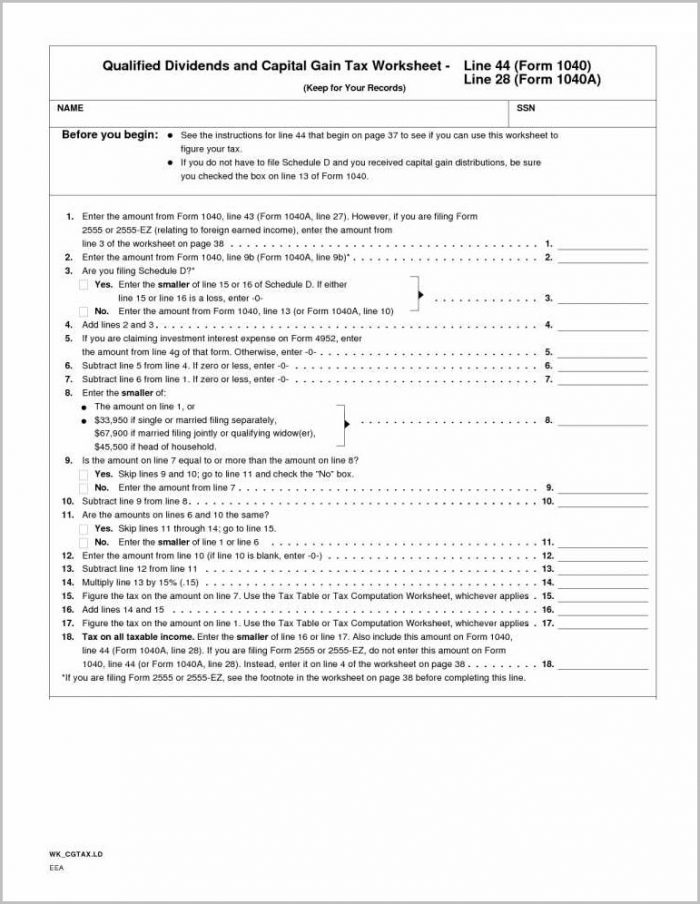

What Is Federal Carryover Worksheet - Web identify in which section(s) of part ii the corporation may take tax credit(s). This worksheet is only available in proseries. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. What is a federal carryover worksheet. Credits without carryover provisions are listed on schedule p (100) in section a1 and may be taken only. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web december 11, 2022by amber. Please note the following correction to the capital loss carryover worksheet in the 2020. It means you have a loss carryover, which means you couldn't use it. Web scroll down to the carryovers to 2022 smart worksheet. Enter the section 179 as a positive number on line a. The cob request amount includes the federal carryover amount plus 20% of the total cob budget for the non. This worksheet is only available in proseries. Web the nol carryover on line 14a of the federal carryover worksheet is calculated on the nol worksheet. Credits without carryover provisions are. Web identify in which section(s) of part ii the corporation may take tax credit(s). Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. It means you have a loss carryover, which means. Credits without carryover provisions are listed on schedule p (100) in section a1 and may be taken only. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. It means you have a. It means you have a loss carryover, which means you couldn't use it. Web december 11, 2022by amber. Web scroll down to the carryovers to 2022 smart worksheet. Web the nol carryover on line 14a of the federal carryover worksheet is calculated on the nol worksheet. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. It means you have a loss carryover, which means you couldn't use it. Web capital loss carryover worksheet. Web identify in which section(s). Enter the section 179 as a positive number on line a. Web december 11, 2022by amber. Web june 4, 2019 6:35 pm. Entering section 179 carryover from a schedule f:. Please note the following correction to the capital loss carryover worksheet in the 2020. Credits without carryover provisions are listed on schedule p (100) in section a1 and may be taken only. Entering section 179 carryover from a schedule f:. Web capital loss carryover worksheet. Enter the section 179 as a positive number on line a. Web identify in which section(s) of part ii the corporation may take tax credit(s). Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Entering section 179 carryover from a schedule f:. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to. Credits without carryover provisions are listed on schedule p (100) in section a1 and may be taken only. The cob request amount includes the federal carryover amount plus 20% of the total cob budget for the non. Web june 4, 2019 6:35 pm. Web the nol carryover on line 14a of the federal carryover worksheet is calculated on the nol. What is a federal carryover worksheet. Web capital loss carryover worksheet. Web december 11, 2022by amber. It means you have a loss carryover, which means you couldn't use it. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. What is a federal carryover worksheet. Web the nol carryover on line 14a of the federal carryover worksheet is calculated on the nol worksheet. Enter the section 179 as a positive number on line a. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. The cob request amount includes the federal carryover amount plus 20% of the total cob budget for the non. Web capital loss carryover worksheet. Web scroll down to the carryovers to 2022 smart worksheet. Web december 11, 2022by amber. It means you have a loss carryover, which means you couldn't use it. Credits without carryover provisions are listed on schedule p (100) in section a1 and may be taken only. Entering section 179 carryover from a schedule f:. Web identify in which section(s) of part ii the corporation may take tax credit(s). Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. This worksheet is only available in proseries. Web june 4, 2019 6:35 pm. Please note the following correction to the capital loss carryover worksheet in the 2020. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. The cob request amount includes the federal carryover amount plus 20% of the total cob budget for the non. This worksheet is only available in proseries. Web capital loss carryover worksheet. Web the nol carryover on line 14a of the federal carryover worksheet is calculated on the nol worksheet. Credits without carryover provisions are listed on schedule p (100) in section a1 and may be taken only. Web scroll down to the carryovers to 2022 smart worksheet. It means you have a loss carryover, which means you couldn't use it. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. Entering section 179 carryover from a schedule f:. Please note the following correction to the capital loss carryover worksheet in the 2020. What is a federal carryover worksheet. Web june 4, 2019 6:35 pm.Oklahoma Net Operating Loss(es) Nonresident/PartYear Resident Only

Federal Carryover Worksheet 2019 Worksheet Maker

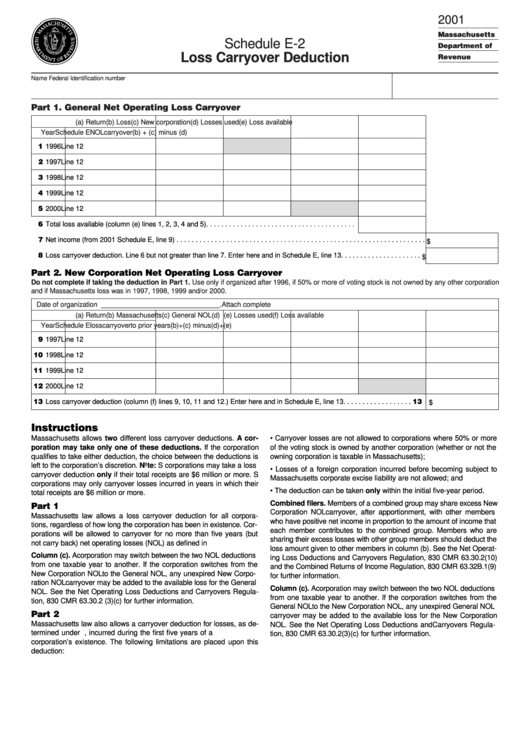

Schedule E2 Loss Carryover Deduction 2001 printable pdf download

Solved Contribution Carryover Worksheet Intuit Accountants Community

Form MNP FCW Download Printable PDF or Fill Online Municipal Net Profit

nol carryover worksheet excel Fill Online, Printable, Fillable Blank

1040 capital loss carryover worksheet

Federal Carryover Worksheet 2019 Worksheet Maker

39 best ideas for coloring Capital Loss Carryover Worksheet

1040 capital loss carryover worksheet

Web December 11, 2022By Amber.

Enter The Section 179 As A Positive Number On Line A.

Web Use This Worksheet To Figure Your Capital Loss Carryovers From 2017 To 2018 If Your 2017 Schedule D, Line 21, Is A Loss And (A) That Loss Is A Smaller Loss Than The Loss On Your.

Web Identify In Which Section(S) Of Part Ii The Corporation May Take Tax Credit(S).

Related Post:

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)