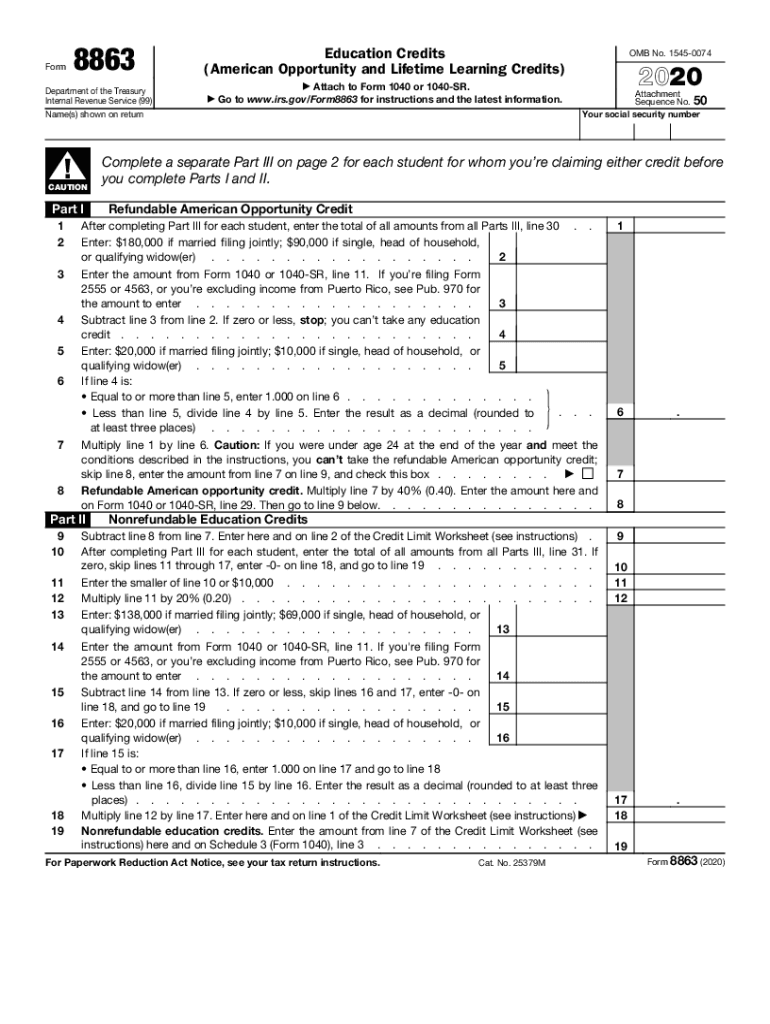

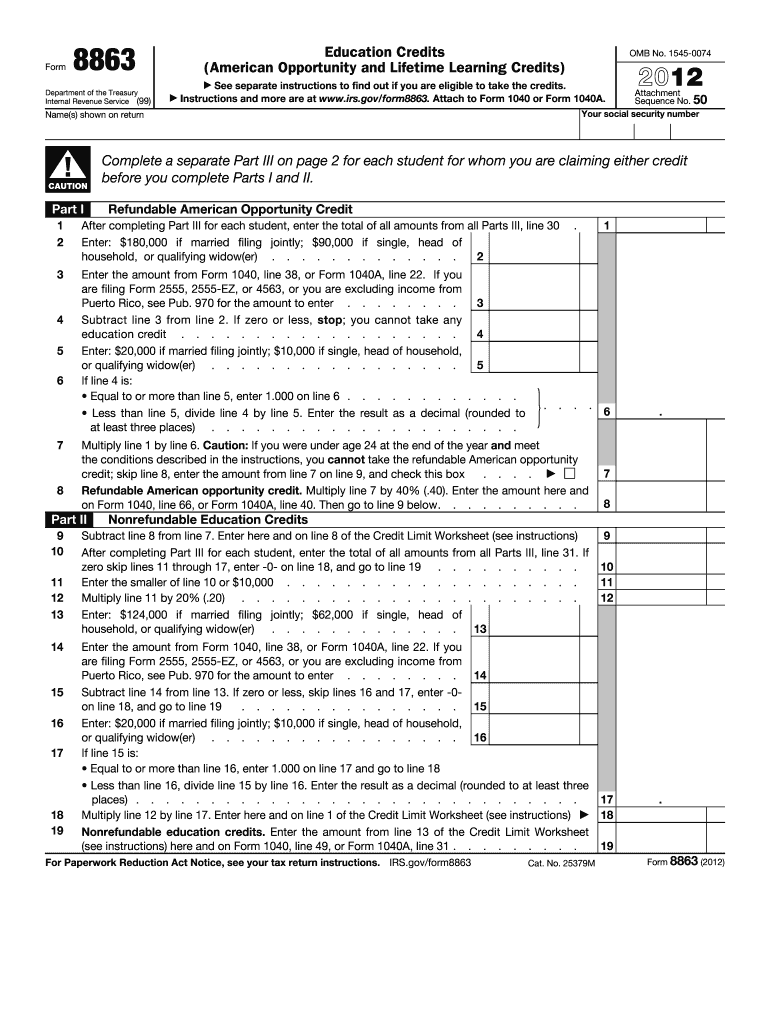

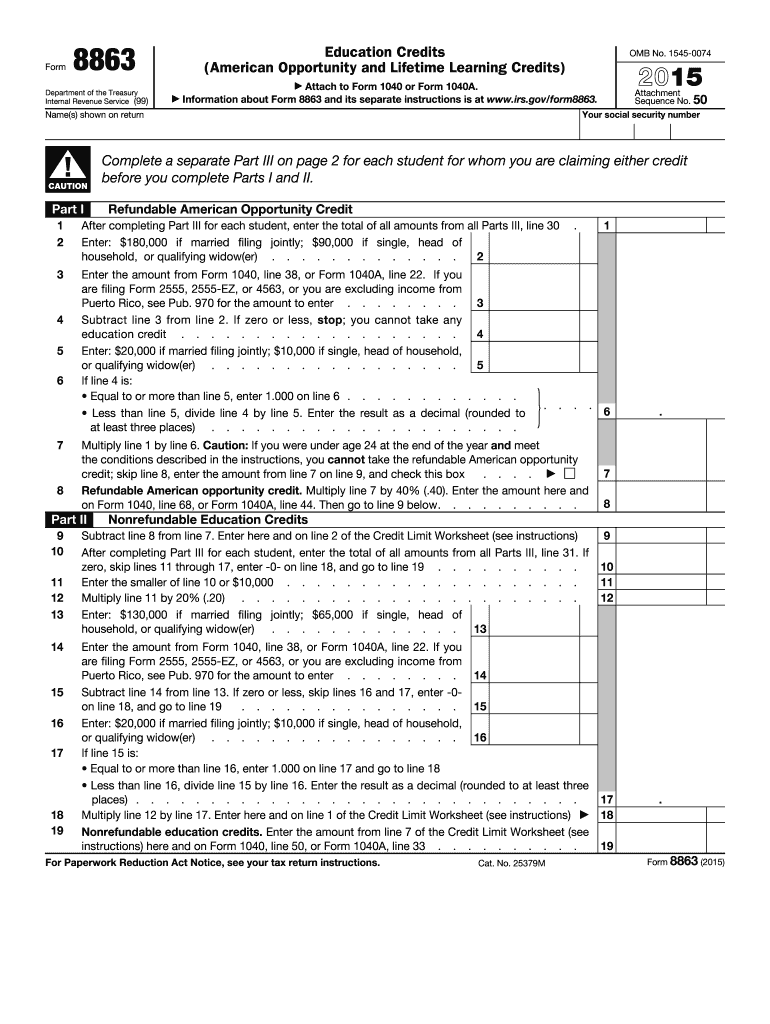

What Is The Credit Limit Worksheet For Form 8863

What Is The Credit Limit Worksheet For Form 8863 - Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. Web form 8863 credit limit worksheet is a document couples should consult when preparing their tax returns. This worksheet helps determine the maximum amount of loan that can be claimed. Web to claim the aotc, taxpayers must file form 8863, including a credit limit worksheet. Line 49, or form 1040a, line 31. Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were published,. That worksheet won't appear in turbotax, even though the program uses. Web 6 rows the credit limit worksheet of form 8863 is a section of the form that is used to. Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. The worksheet shows the amount of education and other tax credits. That worksheet won't appear in turbotax, even though the program uses. Web form 8863 credit limit worksheet is a document couples should consult when preparing their tax returns. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. Web for the latest information about developments related to form 8863 and its instructions, such. Web to claim the aotc, taxpayers must file form 8863, including a credit limit worksheet. Web form 8863 credit limit worksheet is a document couples should consult when preparing their tax returns. Line 49, or form 1040a, line 31. This worksheet helps determine the maximum amount of loan that can be claimed. Web i believe you are referring to the. Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. Line 49, or form 1040a, line 31. The worksheet shows the amount of education and other tax credits.. Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. Web form 8863 credit limit worksheet is a document couples should consult when preparing their tax returns. This worksheet helps determine the maximum amount of loan that can be claimed. Web i believe you are. Web form 8863 credit limit worksheet is a document couples should consult when preparing their tax returns. That worksheet won't appear in turbotax, even though the program uses. Web to claim the aotc, taxpayers must file form 8863, including a credit limit worksheet. The worksheet shows the amount of education and other tax credits. Web for the latest information about. That worksheet won't appear in turbotax, even though the program uses. This worksheet helps determine the maximum amount of loan that can be claimed. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. Web to claim the aotc, taxpayers must file form 8863, including a credit limit worksheet. Web 6 rows the. Web to claim the aotc, taxpayers must file form 8863, including a credit limit worksheet. Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were published,. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. Web form 8863 credit limit worksheet. That worksheet won't appear in turbotax, even though the program uses. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. Web 6 rows the credit limit worksheet of form 8863 is a section of the form that is used to. Line 49, or form 1040a, line 31. Web for the latest information. Web 6 rows the credit limit worksheet of form 8863 is a section of the form that is used to. Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. That worksheet won't appear in turbotax, even though the program uses. Web form 8863 credit. This worksheet helps determine the maximum amount of loan that can be claimed. Line 49, or form 1040a, line 31. The worksheet shows the amount of education and other tax credits. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. Web the credit limit workbook of form 8863 include information about which. Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. Line 49, or form 1040a, line 31. Web form 8863 credit limit worksheet is a document couples should consult when preparing their tax returns. That worksheet won't appear in turbotax, even though the program uses. The worksheet shows the amount of education and other tax credits. Web to claim the aotc, taxpayers must file form 8863, including a credit limit worksheet. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812. Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were published,. This worksheet helps determine the maximum amount of loan that can be claimed. Web 6 rows the credit limit worksheet of form 8863 is a section of the form that is used to. Web the credit limit workbook of form 8863 include information about which taxpayer's generate, instruction expenses, and other factors that affect the tax credit calculator. Web form 8863 credit limit worksheet is a document couples should consult when preparing their tax returns. Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were published,. The worksheet shows the amount of education and other tax credits. Line 49, or form 1040a, line 31. This worksheet helps determine the maximum amount of loan that can be claimed. Web to claim the aotc, taxpayers must file form 8863, including a credit limit worksheet. Web i believe you are referring to the credit limit worksheet in the instructions to form 8812.IRS 8863 Line 23 Fill and Sign Printable Template Online US Legal Forms

Form 8863 Fill out & sign online DocHub

Form 8863 Education Credits American Opportunity And Lifetime Learning

8863 Form 2022

Read PDF form 8863 credit limit worksheet (PDF) vcon.duhs.edu.pk

Fill Free fillable Form 8863 (American Opportunity and Lifetime

2019 Form IRS 8863 Fill Online, Printable, Fillable, Blank pdfFiller

Publication 970 (2017), Tax Benefits for Education Internal Revenue

Form 8863 Fill Out and Sign Printable PDF Template signNow

Form 8863 Credit Limit Worksheets

That Worksheet Won't Appear In Turbotax, Even Though The Program Uses.

Web 6 Rows The Credit Limit Worksheet Of Form 8863 Is A Section Of The Form That Is Used To.

Related Post: