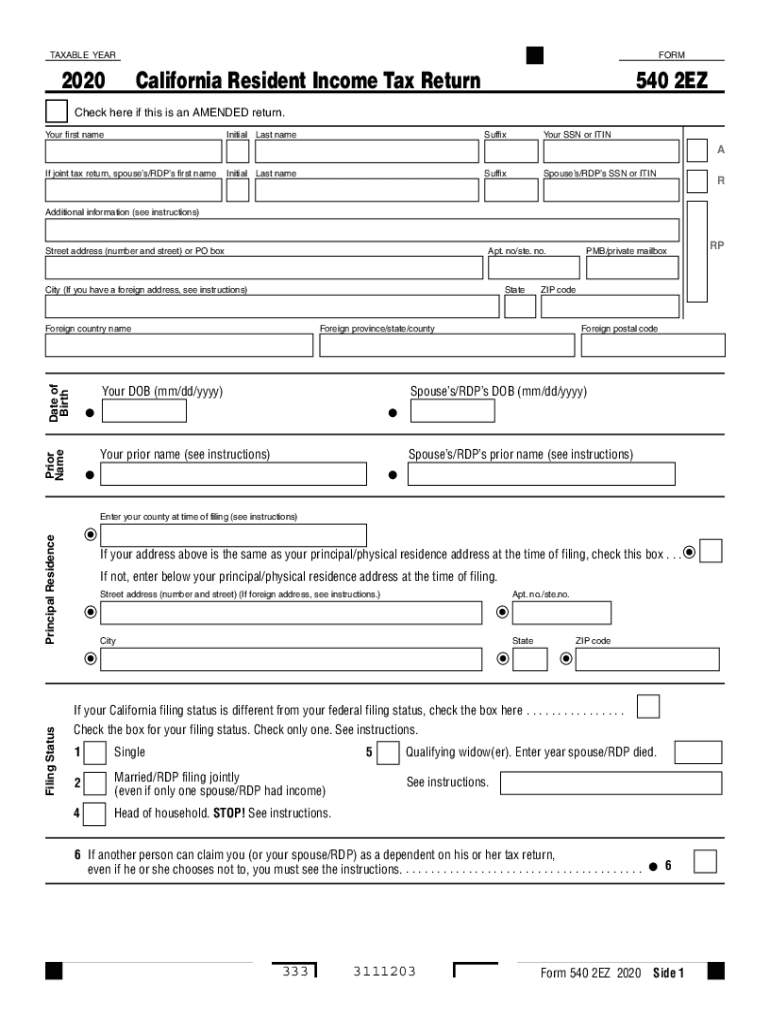

California Dependent Tax Worksheet

California Dependent Tax Worksheet - Your key california tax reference book for 2024. This tax reference guide is a great resource for anyone working with california income tax. Web california employer payroll tax account number. If your total income will be $200,000 or less ($400,000 or. Web simplified income, payroll, sales and use tax information for you and your business Say goodbye to the hassle of nanny taxes and payroll, with our expert service. Web compare the state income tax withheld with your estimated total annual tax. Web the state of california allows a tax credit for dependents, including. Web it is a turbotax bug. Web standard deduction worksheet for dependents (2022) use this worksheet only if. Use worksheet a for regular. Did not live with your spouse/rdp during. Web the same for california purposes as it is for federal purposes, with one important. This publication discusses some tax rules that affect every person who may. Web compare the state income tax withheld with your estimated total annual tax. Web the state of california allows a tax credit for dependents, including. Web if another person can claim you (or your spouse/rdp) as a dependent on his or her tax. Web the same for california purposes as it is for federal purposes, with one important. Web it is a turbotax bug. This publication discusses some tax rules that affect every. Web some turbotax users are reporting an error with their california. This tax reference guide is a great resource for anyone working with california income tax. Web tax year listing child as a tax dependent, or copies of other documents, as listed. We will handle everything from tax filings to wage rates, so you can focus on what matters. Web. Web tax year listing child as a tax dependent, or copies of other documents, as listed. Web it is a turbotax bug. Web compare the state income tax withheld with your estimated total annual tax. Say goodbye to the hassle of nanny taxes and payroll, with our expert service. Web california employer payroll tax account number. This publication discusses some tax rules that affect every person who may. Use worksheet a for regular. Web some turbotax users are reporting an error with their california. Web standard deduction worksheet for dependents (2022) use this worksheet only if. Web if another person can claim you (or your spouse/rdp) as a dependent on his or her tax. Web if another person can claim you (or your spouse/rdp) as a dependent on his or her tax. A dependent qualifies if they were either: Web compare the state income tax withheld with your estimated total annual tax. Web file a married filing separate or rdp return. In 2021, $350 was added in the federal worksheet. This worksheet is used only for the taxpayer or spouse who. Web california employer payroll tax account number. Web standard deduction worksheet for dependents (2022) use this worksheet only if. We will handle everything from tax filings to wage rates, so you can focus on what matters. Web it is a turbotax bug. This worksheet is used only for the taxpayer or spouse who. A dependent qualifies if they were either: Use worksheet a for regular. This tax reference guide is a great resource for anyone working with california income tax. Web some turbotax users are reporting an error with their california. A dependent qualifies if they were either: Web tax year listing child as a tax dependent, or copies of other documents, as listed. Say goodbye to the hassle of nanny taxes and payroll, with our expert service. Mentally or physically incapable of. Web the state of california allows a tax credit for dependents, including. In 2021, $350 was added in the federal worksheet. Web some turbotax users are reporting an error with their california. Say goodbye to the hassle of nanny taxes and payroll, with our expert service. Web file a married filing separate or rdp return. Your key california tax reference book for 2024. Web if another person can claim you (or your spouse/rdp) as a dependent on his or her tax. Web dependent and other credits. This tax reference guide is a great resource for anyone working with california income tax. This worksheet is used only for the taxpayer or spouse who. We will handle everything from tax filings to wage rates, so you can focus on what matters. A dependent qualifies if they were either: In 2021, $350 was added in the federal worksheet. Web tax year listing child as a tax dependent, or copies of other documents, as listed. Web the state of california allows a tax credit for dependents, including. This publication discusses some tax rules that affect every person who may. Say goodbye to the hassle of nanny taxes and payroll, with our expert service. Web compare the state income tax withheld with your estimated total annual tax. Web the same for california purposes as it is for federal purposes, with one important. Mentally or physically incapable of. Web standard deduction worksheet for dependents (2022) use this worksheet only if. Use worksheet a for regular. Web it is a turbotax bug. Web simplified income, payroll, sales and use tax information for you and your business Web california employer payroll tax account number. Web some turbotax users are reporting an error with their california. We will handle everything from tax filings to wage rates, so you can focus on what matters. Web it is a turbotax bug. Mentally or physically incapable of. Web dependent and other credits. Web california employer payroll tax account number. Did not live with your spouse/rdp during. Web simplified income, payroll, sales and use tax information for you and your business Web compare the state income tax withheld with your estimated total annual tax. This worksheet is used only for the taxpayer or spouse who. Web some turbotax users are reporting an error with their california. Web if another person can claim you (or your spouse/rdp) as a dependent on his or her tax. This publication discusses some tax rules that affect every person who may. Use worksheet a for regular. Web the state of california allows a tax credit for dependents, including. Say goodbye to the hassle of nanny taxes and payroll, with our expert service. Web the same for california purposes as it is for federal purposes, with one important.Montana Deduction Fill Out and Sign Printable PDF Template signNow

Pdf

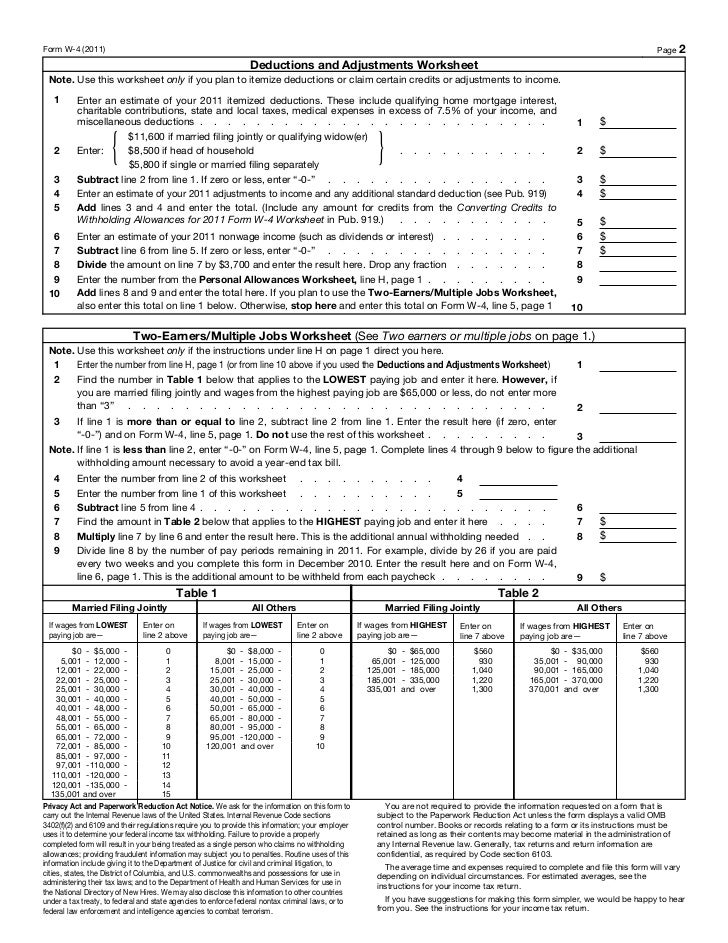

30++ Child Tax Credit Worksheet 2019

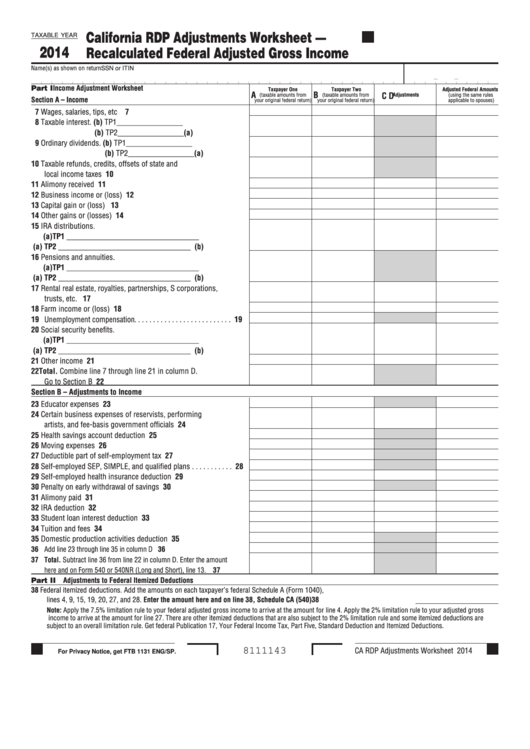

California Rdp Adjustments Worksheet Recalculated Federal Adjusted

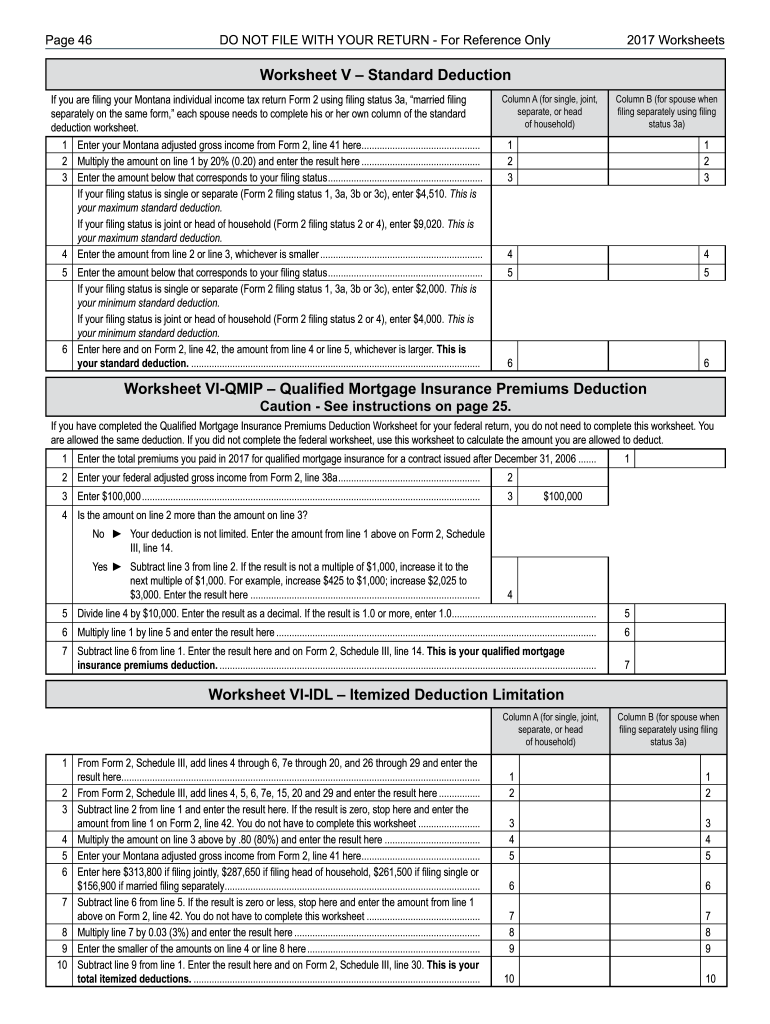

Standard Deduction Worksheet for Dependents

California Itemized Deductions Worksheet

540ez Dependent Tax Worksheet Studying Worksheets

Care Credit Printable Application Printable Word Searches

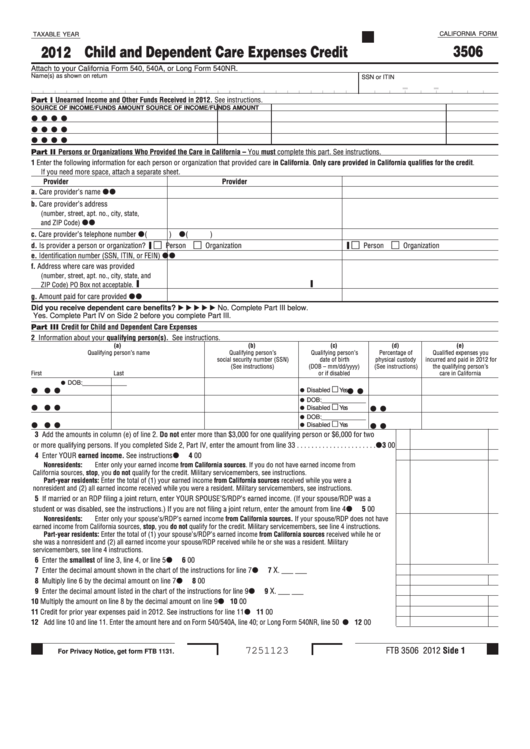

Fillable California Form 3506 Child And Dependent Care Expenses

️Irs Dependent Verification Worksheet Free Download Goodimg.co

In 2021, $350 Was Added In The Federal Worksheet.

Web Standard Deduction Worksheet For Dependents (2022) Use This Worksheet Only If.

A Dependent Qualifies If They Were Either:

If Your Total Income Will Be $200,000 Or Less ($400,000 Or.

Related Post: